Home Staging is Worth It, No Matter What the Market Looks Like

Cynthia Chavoustie

Whether the market is hot or cold, home staging is worth it. It will keep your home hot and attractive to buyers. Plus it will make it more likely to sell faster and for top dollar than if it was not staged.

Studies and experts alike agree that home staging is worth it, no matter what the market looks like.

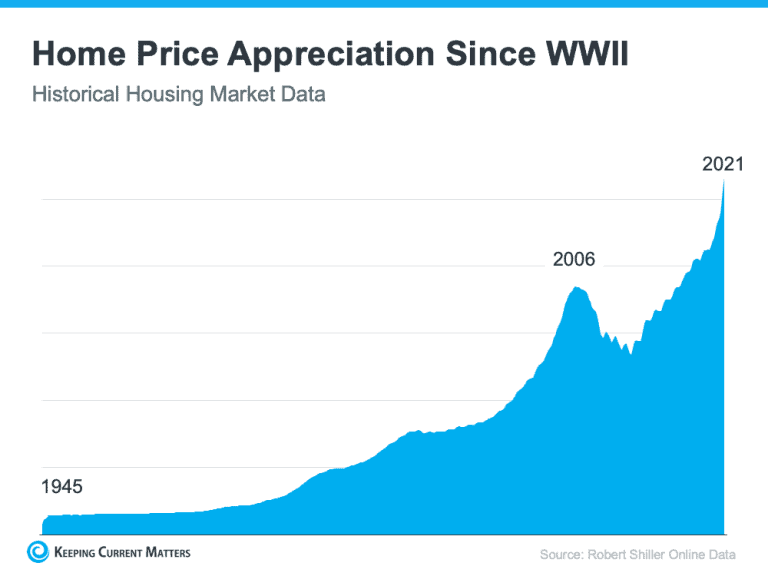

While it’s true that in a seller’s market homes go quickly no matter what, the the housing market is slowly cooling. So, if you want to get top dollar for your home, home staging is worth the minor investment.

Additionally, if you want your home to stand out and receive the most and highest offers possible. Basically, you want buyers to fall in love with the home.

How does staging capture buyers’ hearts for a successful, top-dollar sale? Read on…

Help Buyers Emotionally Connect With the Home

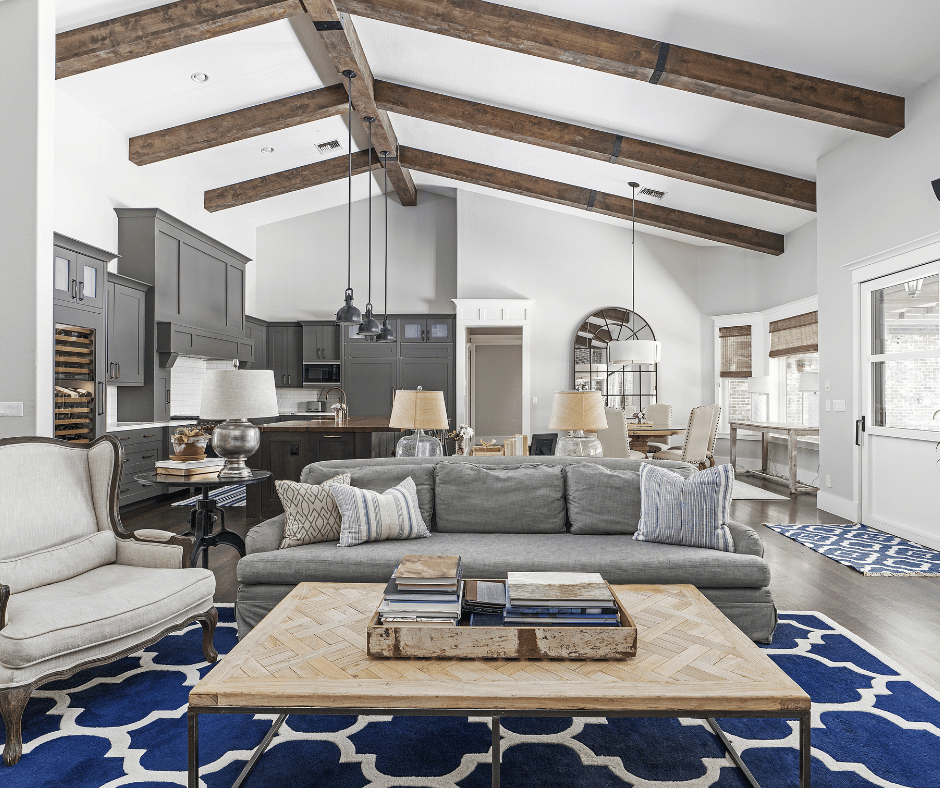

Home Staging is all about presenting the house as a warm, move-in ready home that ideally home buyers can visualize themselves in.

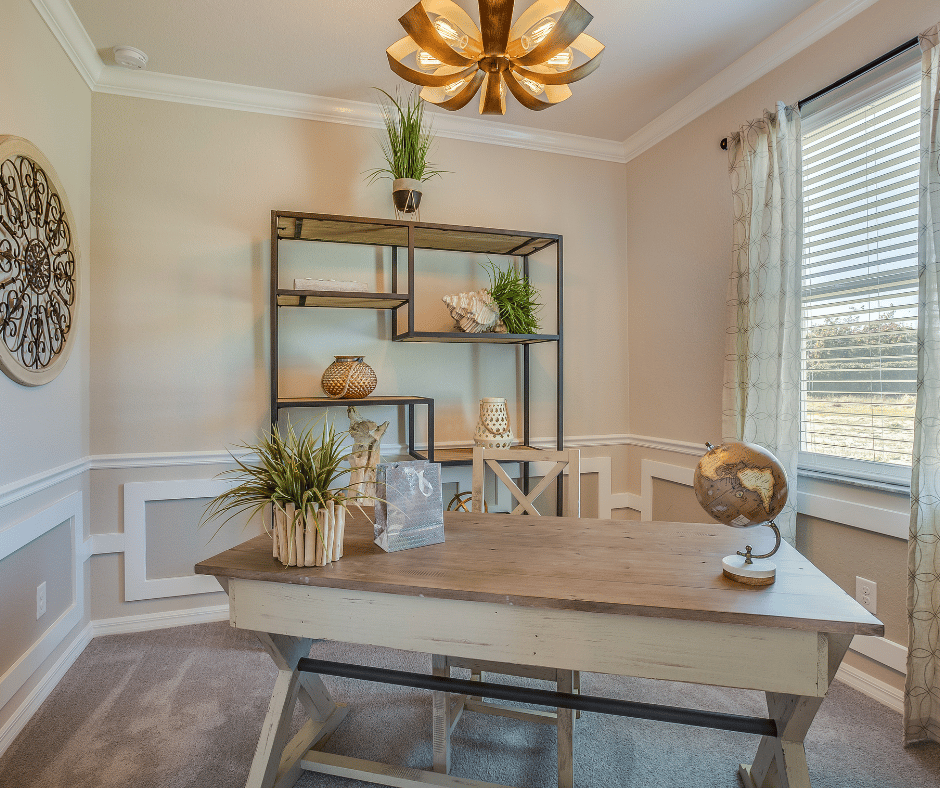

Update your décor with popular, on-trend style. Specifically, updates in living rooms, main bedrooms, and kitchens definitely make a positive impression. If homebuyers can start to see what it would look like to live in that home, they are likely to be more committed. They will also like be more willing to place a high offer. Moreover, if they can see themselves in the home, they are less likely to change their minds last minute or ask for a ton of concessions.

According to The National Association of Realtors®‘s 2021 Profile of Home Staging, 82% of buyers’ agents said home staging helped their clients visualize the property as their home.

Home Staging is Worth It.

Home Staging is Worth it Because it Increases Perceived Value of the Home

Staging can minimize the negatives and accentuate the positives of a property. Basically, it will help your home make the best impression possible.

- Start by decluttering and depersonalizing so the buyers don’t see it as “your” house with all the personal effects.

- Add a coat of neutral wall color to brighten the space

- Remove dated window treatments and coverings

- Strategically arranging furniture

- Remove bulky pieces

These simple updates will help buyers see the home’s unique features and increase the perceived value.

> 25% of buyers are willing to overlook outright property faults if a home is staged, according to NAR's 2021 Profile of Home Staging. Staging is worth it.

It’s no surprise that a cold, empty property will not get the same attention as one filled with stylish, warm furnishings and accessories. Home staging instantly creates a more inviting room. Additionally, homebuyers can get an idea of what kind of furniture would fit in the space.

Staging Creates Attractive Online Images that Draw Attention

Furthermore, you may only have one chance to catch the eye of homebuyers scrolling through hundreds of pictures online. Nearly all—99%—of millennial home buyers start their search online, according to NAR’s data. Even in a hot market, staging a property to look amazing in photos will draw more buyers to see the home in person and even submit an offer.

Statistics Show Staging Is Worth the Investment

Lastly, staging is an investment which helps maximize the rate of return on the sale of the property. Cost to stage a vacant home can vary, typically less than or around $5000 and usually less than the first price reduction!

With an average investment of 1% of the sale price into staging, about 75% of sellers saw an ROI of 5% to 15% over asking price, according to data from the Real Estate Staging Association (RESA).

A recent survey from the International Association of Home Staging Professionals shows that staging helps sell homes three to 30x faster than the non-staged competition. Further, staging can help increase the sale price by up to 20% on average.

For those who decide not to stage, the average price reduction on a home was 5 to 20 times more than what it would have cost to stage the home. Not to mention the higher selling price they probably would have received as well.

All things considered, you can see that there is a strong argument that staging is worth the investment (which in perspective is a small one at that).