Should I Rent or I Buy a House? 5 Factors to Consider

Cynthia Chavoustie

It’s a recurrent question in the mind of every renter as they see their rent continue to rise. Just in this last year, Colorado saw an increase of rental rates by almost 22% according to Rent.com. Their records show that in 2020, the average monthly rent for a one bedroom was $1,574. In 2021, according to their report, the average monthly rent for a one bedroom was $1,919.

And if you think rental prices will come down, don’t hold your breath. That just doesn’t really happen. According to nationwide Census data, rent has risen consistently for decades. Decades. They may not rise as quickly as they have recently, but they aren’t going down.

Buying a home is a major life decision and one that no one should enter into lightly. But at the rate rent is rising, it’s no wonder that we are getting so many renters wondering if now is the time to take the plunge into homeownership. I mean… having a stable monthly mortgage rate where you are actually investing in something that could bring you more money down the line, sounds really appealing in contrast to the steep increase in rent that is not likely to change anytime soon.

Are you asking yourself “Should I continue to rent or buy a home?”

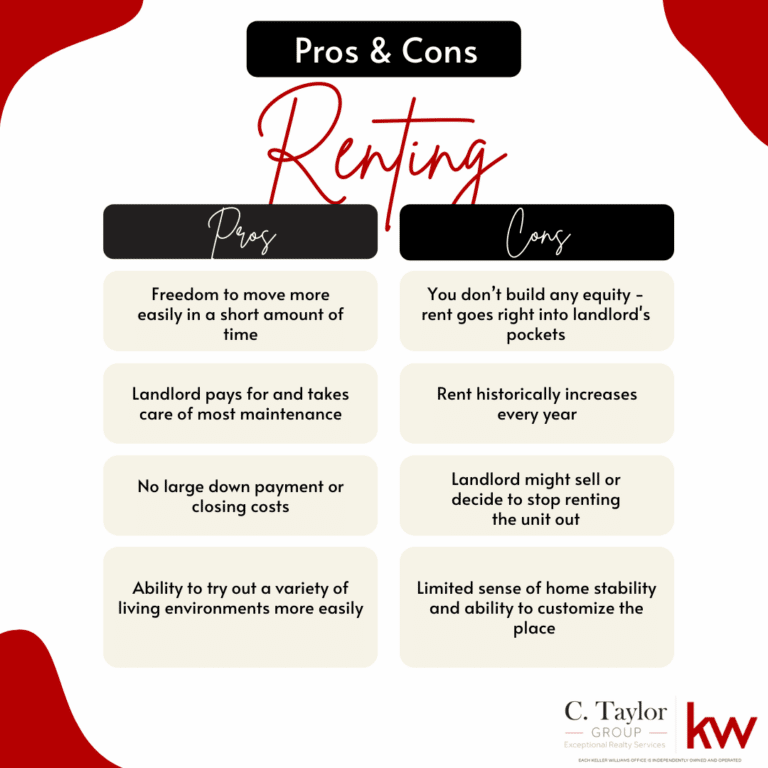

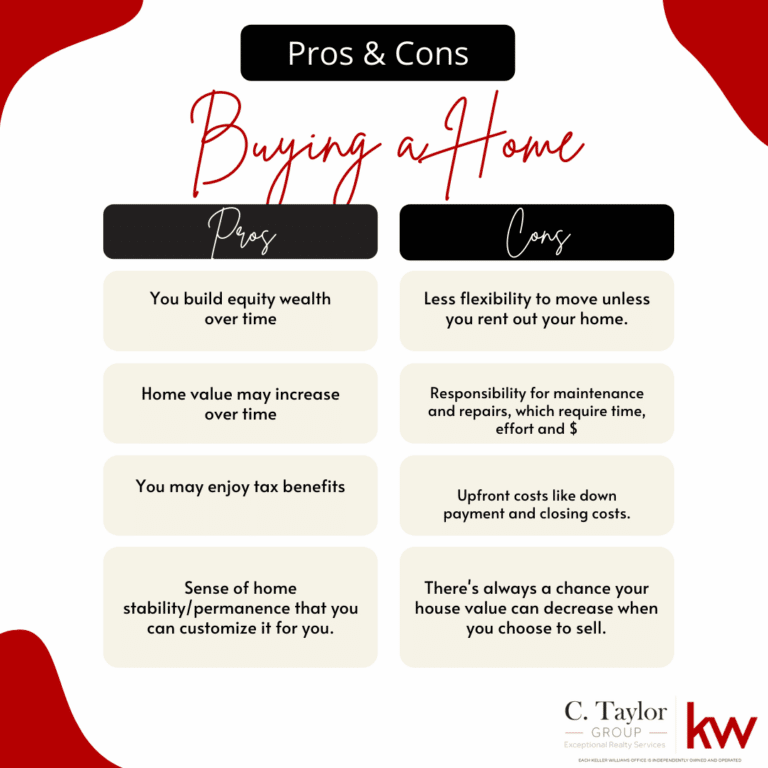

Of course, there’s no single correct answer for everyone. There are pros and cons to both renting and buying along with several factors that will help you know whether renting or buying a home is right for you right now.

Ask yourself…

- Do I like the flexibility renting offers or am I ready to put down some roots?

- How do I feel about the costs of renting vs buying?

- Do I know about the risks of renting vs buying?

- What are my career and other long term goals?

- Can I afford to buy a house right now?

If you’re on the fence about whether you should rent or buy, read on for:

5 Important Factors to Consider when Deciding Whether to Rent or Buy a Home…

1. Flexibility or Stability?

Do you thrive on being able to pick and relocate whenever you want or need to? Unless you’re good with owning a home and renting it out while you’re elsewhere, homeownership may not be right for you yet. However, if you’re looking around and thinking you might want to put some roots down and get more connected with a community, owning a home could make that happen. Owning a home and staying in it for at least five years can be good for you financially and emotionally – there’s just something about having a place to call “home” and make it all your own.

2. Cost of Renting Vs. Buying

Rent is just a flat monthly rate that typically increases each year. As mentioned above, it has increased significantly over the last 1-2 years but typically it’s a more modest increase. However, it is an increase and the money each month is given to a landlord or property owner and you create no equity to capitalize on in the future.

Owning on the other hand, has quite a few more upfront costs such as a down payment, closing costs, and other miscellaneous home maintenance costs if needed. There are usually some other monthly fees that you may not typically see if you rent. These include property taxes, homeowners insurance and (in many cases) mortgage insurance as well as homeowners association (HOA) fees. If you’re getting financing for your home (i.e. a mortgage), you’ll likely have a set monthly payment that doesn’t increase for a set amount of time, usually 15-30 years.

All those costs can seem overwhelming but keep in mind that buying a home is almost always the better financial decision in the long run and most importantly, it will give you an opportunity to build equity – which in turn will help your credit and provide even more opportunities down the line. Remember also, each payment goes towards paying off the house and when you sell the house (for likely more than you bought it for) you will get to keep the money minus whatever is still owed on the house.

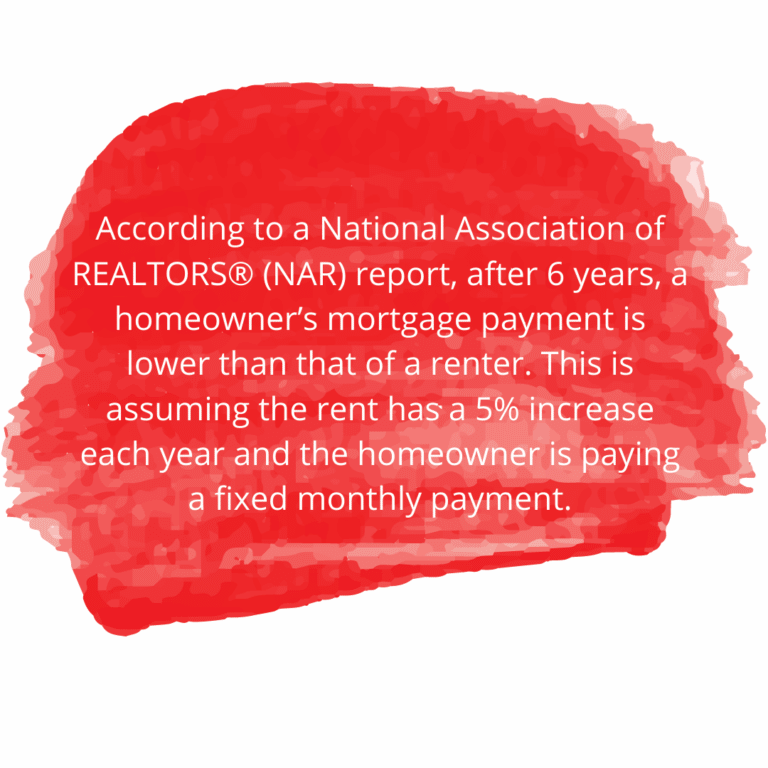

There are also tax savings to being a homeowner, especially if you are a first time home buyer. According to the same NAR report, a homeowner’s payment will be less than a renter’s payment after 3 years.

3. What Are Your Future Plans?

Even with meticulous planning, it’s hard to predict what can happen next in your life. But if you have some idea of where you’d like to be and do with yourself for the next 5-10 years, ask yourself does buying a home fit into that plan? For example, if you intend to stay put in one place for at least 5 years and have the financial means to do so, buying a home probably makes the most sense.

However, if your current life situation offers no hint of stability for the next few years and your housing needs might change, you may want to wait on buying a home. Plus it will give you time to figure out what you do want for the next few years and how to save up and prepare for possibly buying a home in the future.

4. Risks to Renting and to Buying

Like with practically everything, there are risks for both renting and buying a home that you need to keep in mind. While it’s true, you can build equity when buying a home, it’s not a risk-free process. For example, because building equity takes time, if you sell your home sooner than planned, you may not recoup what you spent in closing costs or renovations when you first purchased the home.

And then there are the home maintenance costs. These are expenses you’ll need to pay to keep the home in top condition. Think winter maintenance, blowing out sprinklers, checking air filters and vents, testing fire alarms, landscaping and fixing plumbing issues, among other repairs that can pop up from time to time.

If you’re focused on other life goals, like a career that requires you to travel often, or if you have multiple young children to attend to, adding home maintenance to your list of responsibilities may not be the best choice. Some people love handy work around the home but if you have a career or a young family that needs a lot of your attention, you may want to reconsider owning a home unless, of course, you can pay someone else to do those things for you!

5. Affordability

Last but definitely not least, is affordability. Can you afford to buy a house right now? When considering whether or not you should rent or buy a home now, it comes down to whether you can financially. We want you to understand all the pros and cons to home buying vs renting and you should be realistic about what you can and want to do.

You also need to take into consideration what the market is doing and what projections are for the near future if you decide to wait.

As we speak, here in 2022, the demand for housing is still very high and there are still relatively few houses up for sale. This means that house prices are high and while they may not rapidly increase like they did in the last 2 years, they will continue to go up for a while. The benefit to buying right now would be to take advantage of the relatively low mortgage rates and the fact that those are projected to increase. Wait too long though and increased home prices along with higher mortgage rates = higher monthly mortgage payments.

Other key factors that influence affordability include the location and the prices of other homes or rentals in the area you wish to live. You’ll also need to consider your credit score and if a lender would find you creditworthy unless you can pay cash upfront.

Once you’ve factored in the home’s purchase price, down payment and closing costs, as well as a monthly mortgage cost, compare that to the monthly cost of rent and projected costs over a period of time, say 5 years. With that comparison, you’ll be able to see the differences between costs as well as the perceived equity you would’ve built up in a home.

Either way, careful budgeting will help you succeed no matter what you choose, rent or buy.

To Review: Here are some Pros & Cons to Renting and for Buying a Home

Summary

As you can see, there isn’t always a clear answer to the question of whether to rent or buy a home. A lot of factors go into making the decision and depending on your life situation and finances, the answer might change with time.

Homeownership has numerous benefits but if you’re on the fence, consider the pros and cons of each option. Renting may be what’s best for you right now but there are things to think about and we, at The C. Taylor Group, want you to be well informed.