Is Today's Housing Market Going to Crash?

Cynthia Chavoustie

With home prices continuing to rise, are you wondering, "Is Today's Housing Market Going to Crash?"

If so, you’re not alone. It’s a question we get all the time in similar variations… “Are we in a housing bubble?”, “When is the housing bubble going to pop?”, on and on…

It’s a very valid question, especially for those of us who experienced, painfully, the housing market crash of 2008.

But it’s important to understand what led up to the housing crash of 2008 and what’s different today.

First a little history…

Homeownership has always been a cornerstone of the American Dream. Over 86% of Americans agree homeownership is a key part of the American Dream according to a recent report from the National Association of Realtors (NAR).

Before 1950, less than 50% of families owned their own homes but that soon changed with the GI Bill gave many of the returning veterans from WWII the ability to purchase a home. Since then homeownership moved upwards to 65% and the strong desire for owning your own home has continued to grow, helping home values to appreciate over the years.

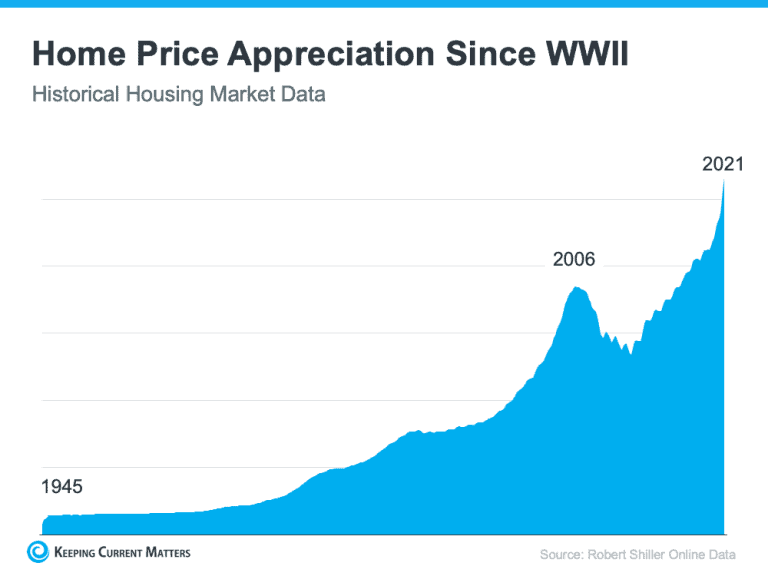

As you can see, the only time home values dropped significantly since 1945 was during when the housing bubble of 2006-2008 popped. While some think the sharp increase in prices during 2006 looks very similar to the rise we’ve seen in the past 2 years and thus means a crash is coming, there are differences between the two periods of increases.

What Happened During the Housing Market Crash of 2008?

In 2006, homebuyers were not truly qualified for the mortgages they were given. Many could not afford to continue paying their mortgages and the market was flooded with foreclosures

⇒ Foreclosures caused a domino effect and banks along with the rest of the economy was in tailspin

⇒ Home values dropped…like off a cliff

⇒ some just walked away from their homes when they realized they owed more than what it was worth

⇒ more foreclosures ⇒ more decline in home values over the next few years.

How is Today’s Housing Market Different?

2 Reasons today’s market is not like the one we experienced 15 years ago…

1. The Demand for Homeownership Today Is Real - Not Created by Banks

Prior to 2006, banks were creating artificial demand by lowering the standards needed to qualify for a home loan or refinance their current home – meaning even those with bad credit history, no stable income, etc… “qualified” for a loan. Today, regulations to prevent a repeat of 2006, require much higher standards to qualify for a loan – you really have to show that you’ll be very likely to make your payments.

For the last year or two, the demand for homeownership is a reaction to the recent COVID-19 world-wide pandemic that caused people to re-evaluate the importance of having a home. Lockdowns will do that! Plus remote work seems like it’s staying around to some degree, increasing the options for those who don’t have to live so close to work. It also increases the demand for a home that can double as an office so many people are looking to move out of their smaller, rented apartments onto a bigger house.

Rent is also going up so renters are now having the desire to build equity and stop giving money to a landlord also drives the demand for home buying.

2. People Are Not Using Their Homes to for Home Equity Loans Like They Did in the Early 2000s

When home prices were on a rapid incline in the early 2000s, many thought it would continue as such and so they started to borrow against the equity in their homes to finance college educations, new cars, boats, and you name it. However, when prices started to fall, many of these homeowners owed more than their house was now worth, causing some to just abandon their homes. This led to more foreclosures.

Homeowners haven’t forgotten the lessons of the housing crash even as prices have skyrocketed the last few years. Accessible home equity has more than doubled compared to 2006 ($4.6 trillion to $9.9 trillion) according to Black Knight.

The latest Homeowner Equity Insights report from CoreLogic reveals that the average homeowner gained $55,300 in home equity over the past year alone.

Today’s homeowners will not face an underwater situation even if prices dip slightly. Overall, homeowners today are much more cautious and there are regulations to make sure banks and others don’t get too greedy.

Summary:

The housing market crash 15 years ago was due to a flood of foreclosures that was fueled by shady mortgage practices. No one wants that to happen again. Therefore, with the increased regulations, stricter mortgage standards and an increasing level of home equity, there is no realistic reason to believe that today’s housing market will crash.